Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Trading volume on decentralized exchanges (DEX) jumped by 88% in the 24 hours after the news that the U.S. Securities and Exchange Commission (SEC) sued centralized crypto exchange Binance.

On June 5, the financial regulator filed 13 charges against Binance and its CEO, Changpeng Zhao, for violating federal securities law and further alleged that the exchange facilitated the trading of crypto securities tokens.

Following the news, DEXs’ trading volume went from $1.2 billion on June 4 to $3.09 billion on June 5, according to data from DeFiLlama.

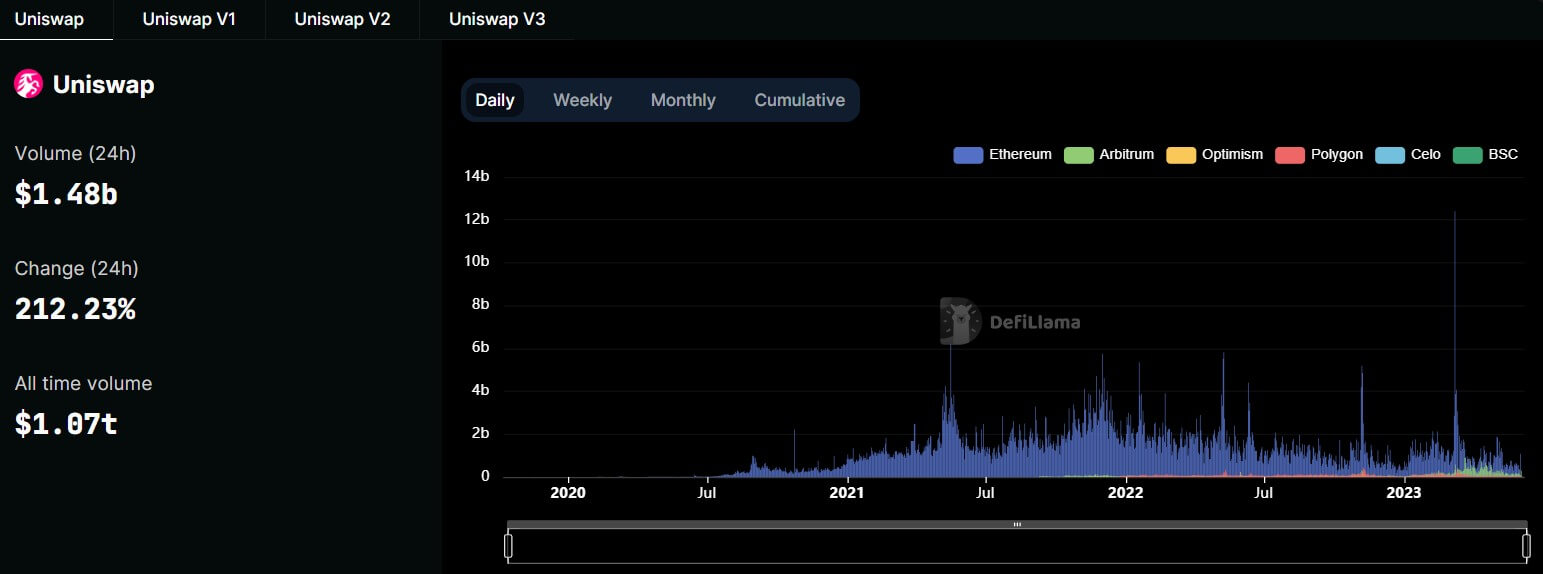

Uniswap dominates volume

DeFiLlama data showed that the dominant DEX during the reporting hours was Uniswap (UNI), which accounted for nearly 50% of the total volume. The platform saw its trading volume increase by over 200% to $1.48 billion across multiple chains.

Source: DeFiLlama

During the period, PancakeSwap (CAKE) saw its volume rise 75% to $481.84 million across Ethereum and BNB smart chain.

Other protocols that recorded significant changes in their trading volume include Dodo with $163.92 million, Curve Finance (CRV) with $156.9 million, and Level Finance with $117.55 million.

Dex’s trading volume on the up

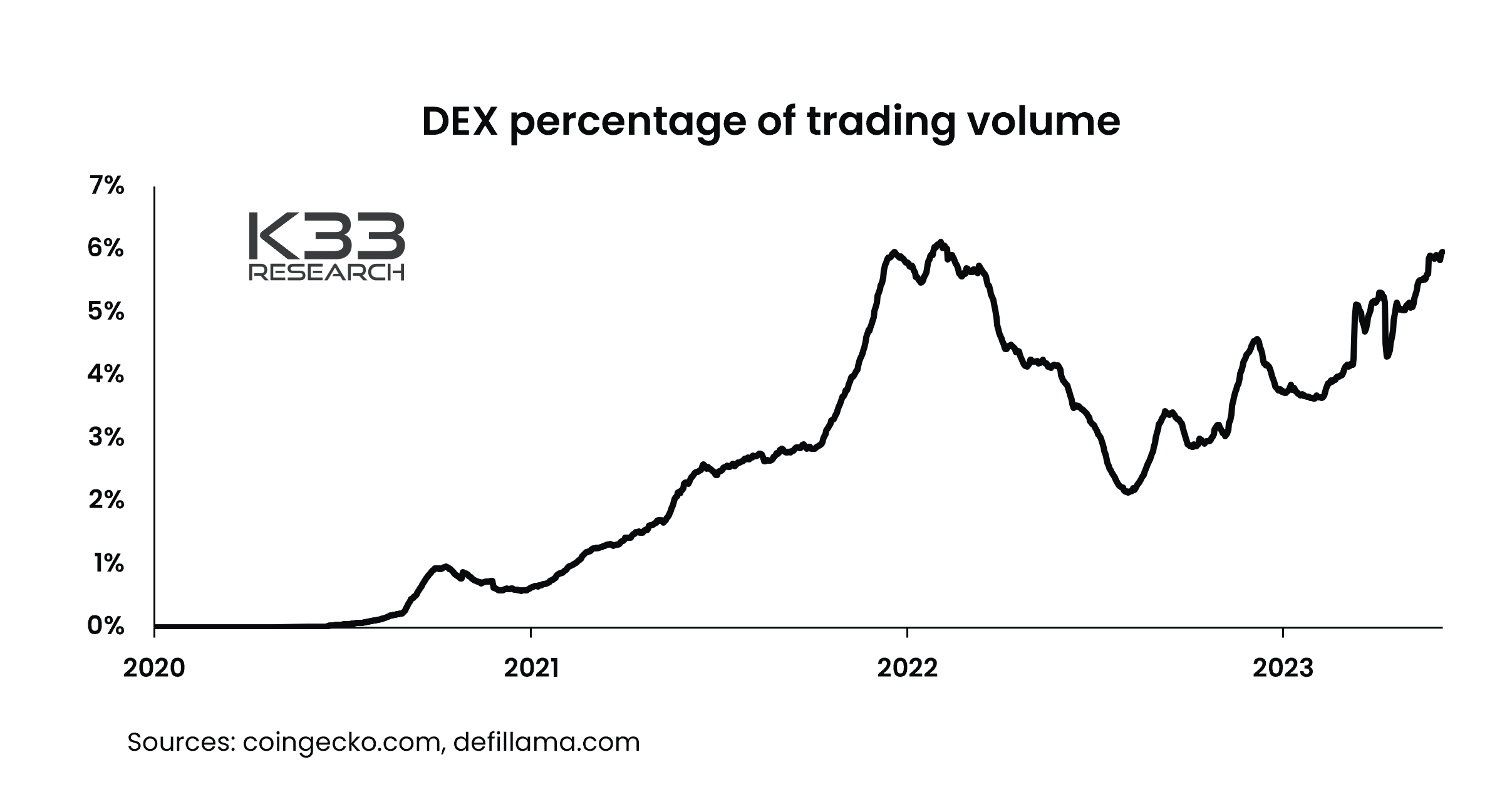

Before the SEC’s lawsuit, trading volume across decentralized exchanges had experienced an uptick thanks to the proliferation of meme coins like PEPE, WOJAK, Turbo, and others.

K33 Research pointed out that DEX volume was nearing the highs of late 2021/early 2022 as a percentage of all trading volume.

Source: K33 Research

Meanwhile, this rise has coincided with a period when centralized exchanges’ trading volume has dropped to its lowest levels since 2020. Centralized platforms have faced heightened regulatory scrutiny from regulators attempting to prevent another event like FTX’s collapse in 2022.

Despite the increased use of decentralized exchanges, the trading volume is still relatively low compared to its previous peaks. In May, the overall DEX volume was $72 billion, far below the $234.27 billion recorded in November 2021, according to DeFiLlama data.

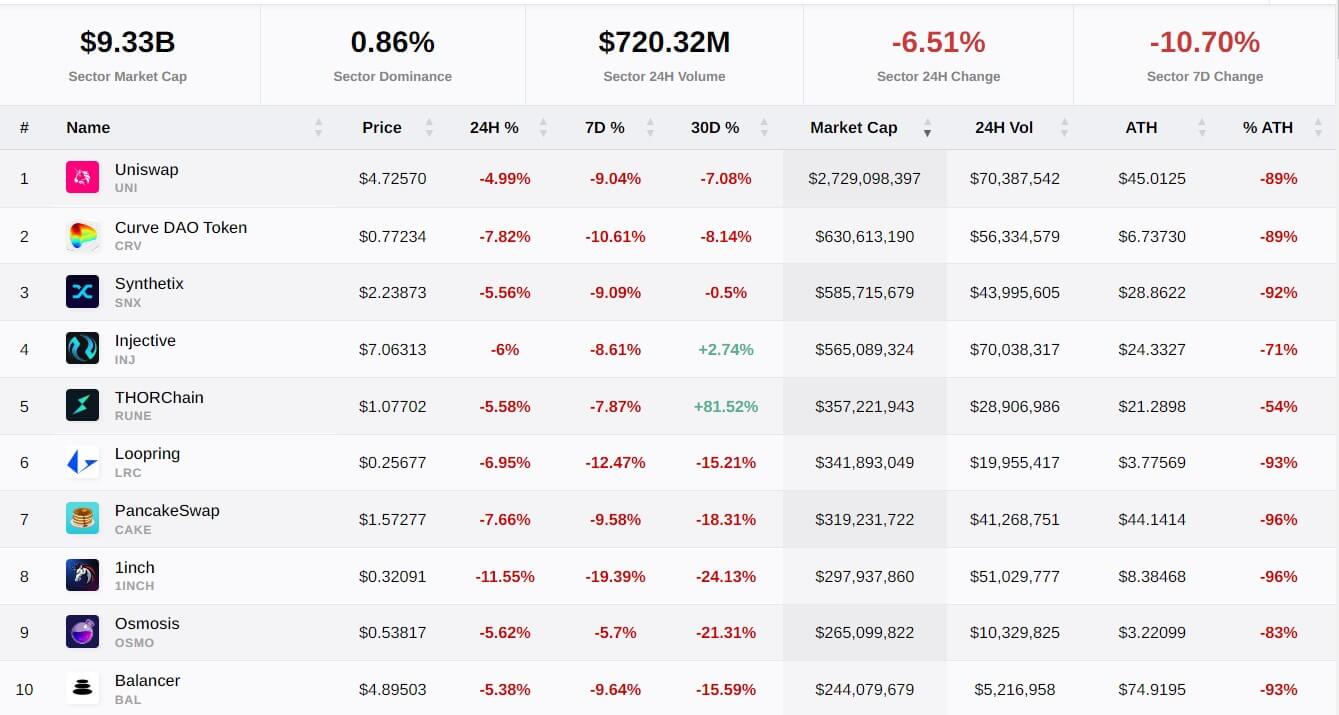

DEX tokens down

However, the shift to DEXs has translated into a positive price performance for the native tokens of these exchanges. According to CryptoSlate’s data, tokens in the sector fell 6.51% in the last 24 hours and by more than 10% in the past week.

Source: CryptoSlate

The sector’s top 10 cryptocurrencies by market cap saw losses during the reporting period, with 1Inch topping the losers list with an 11% decline.

The SEC followed yesterday’s actions by filing suit against Coinbase this morning.

The post Decentralized exchange trading volume grows 88% following SEC lawsuits appeared first on CryptoSlate.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.